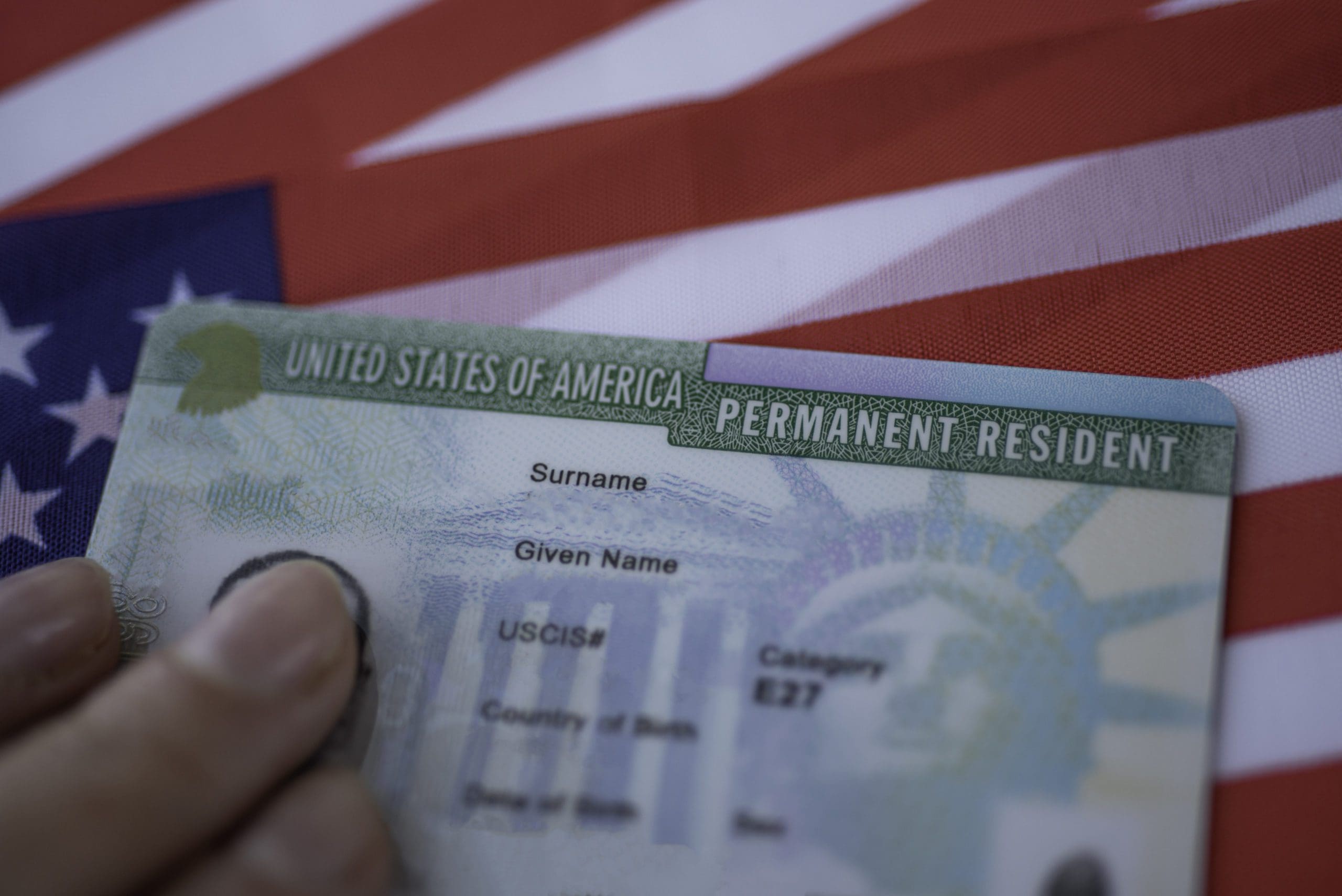

Open banking has matured into a practical engine for faster, smarter lending decisions. With customer permission, lenders access verified income, expenses, and cash-flow histories. This replaces static statements and reduces document fraud risk. Decision times shrink from days to minutes without sacrificing rigor. Consent is the cornerstone of adoption. Clear, revocable permissions and granular scopes reassure applicants. Borrowers can share just enough data to qualify for a better rate or limit. Transparent usage logs and easy disconnect options keep the experience in their control. Personal loan providers use categorized transactions to assess affordability more precisely. Regular obligations, such as rent and utilities, are recognized alongside income volatility. This supports fairer outcomes for gig workers and new-to-credit applicants. Lenders price risk based on real cash flows, not just bureau snapshots. Business lenders benefit from direct feeds to accounting and commerce systems. Reconciliation becomes automated, and revenue trends are visible instantly. That enables revolving facilities, working-capital lines, and inventory financing tuned to actual cash cycles. SMEs get the right product at the right size and moment. Security and compliance remain front and center. APIs enforce strong authentication, encryption, and data minimization. Regulators encourage innovation while demanding robust consumer protections. Done well, open banking aligns incentives for borrowers, lenders, and oversight alike.

Open Banking, Real Results