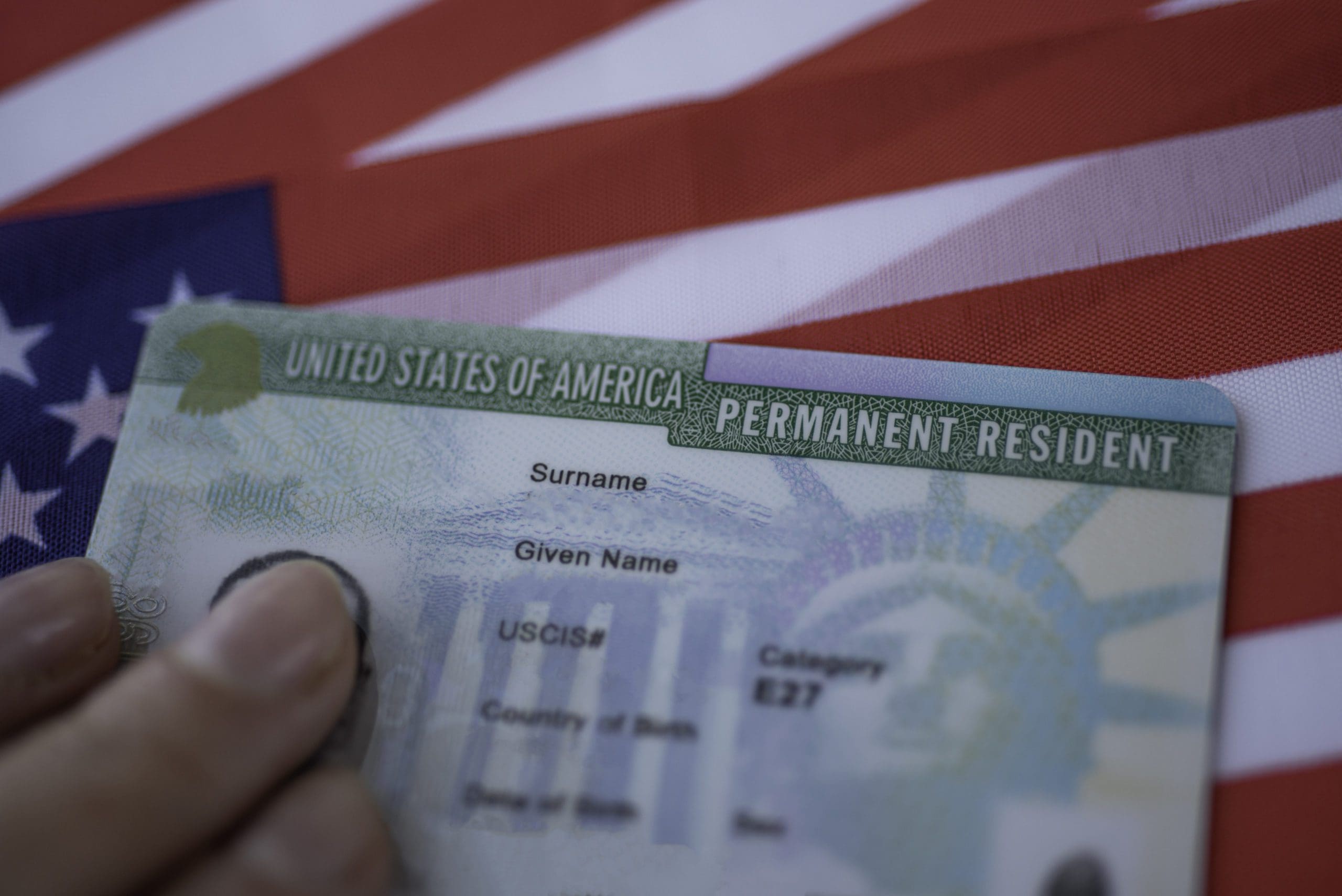

Consumer protection rules continue to shape product design across 2025–2026. Regulators expect affordability checks, clear disclosures, and fair collections. Payday and installment products face particular scrutiny on fees and rollovers. Lenders that exceed the baseline earn durable reputations.

Compliance starts at product inception. Pricing, terms, and communication are tested with real users. Plain-language summaries accompany legal documents to prevent confusion. Digital journeys include checkpoints that confirm understanding before acceptance. Affordability is measured with dynamic income and expense signals. Caps on total cost of credit reduce harmful debt spirals. Hardship options—deferrals, restructures, or fee waivers—support temporary setbacks. Collections emphasize dignified, solution-oriented outreach over pressure. For business loans, transparency on covenants and triggers avoids surprises. Borrowers know exactly what actions are required when metrics slip. Lenders offer remediation steps before default paths engage. Collaborative problem solving preserves value on both sides. Continuous monitoring closes the loop. Complaint data and outcome analytics highlight friction points. Policies evolve with evidence rather than anecdotes. In responsible lending, doing right becomes a competitive edge, not just an obligation.

Regulation and Responsible Lending