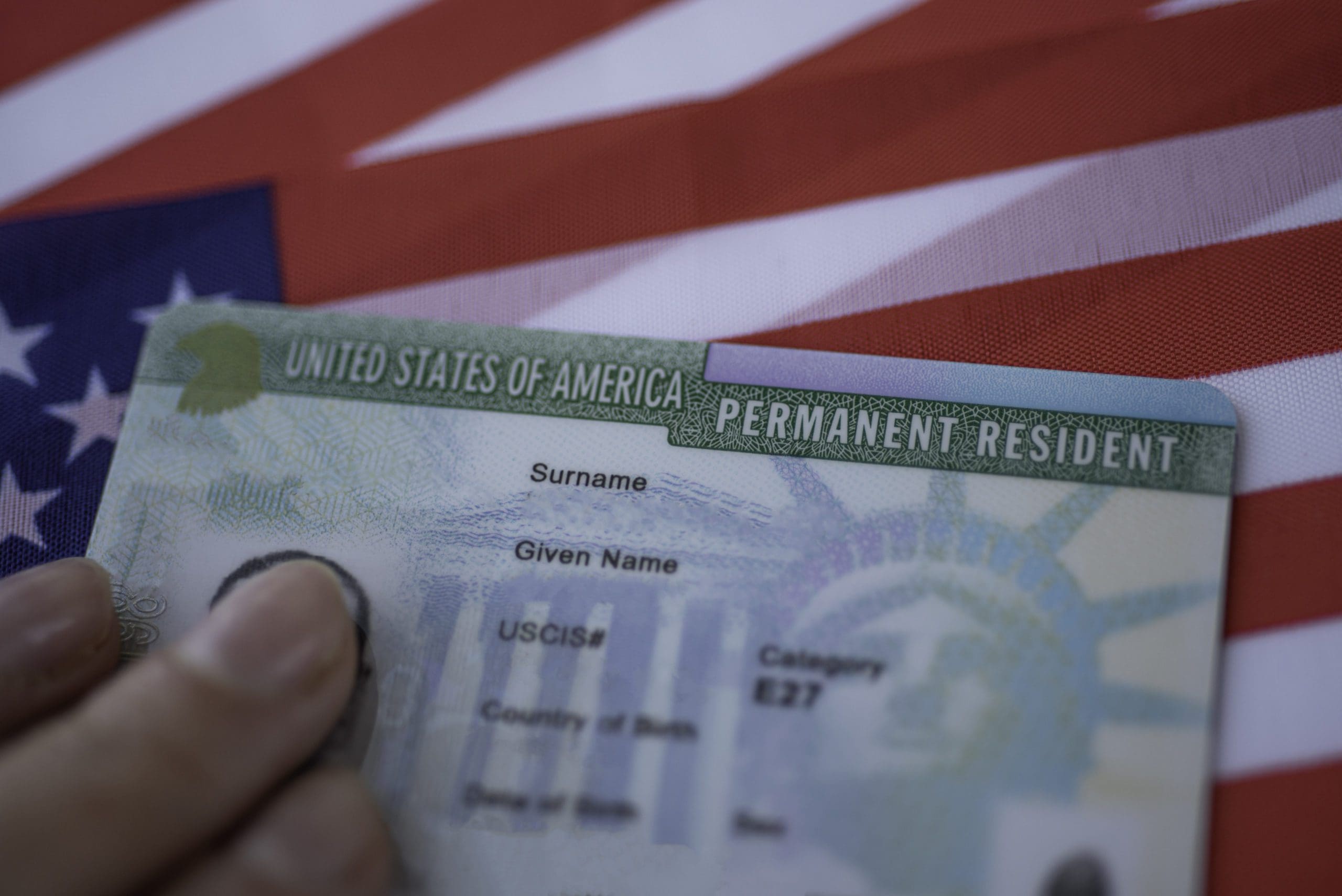

Sustainability has entered mainstream lending for consumers and SMEs. Green loans finance solar panels, efficient appliances, and EVs. Businesses fund energy upgrades and low-carbon equipment. Lenders design products that reward verifiable impact. Eligibility relies on clear taxonomies and documentation. Vendors provide certificates, serials, and installation proofs. Disbursements can be milestone-based to ensure delivery. Transparent criteria prevent greenwashing and confusion. Pricing incentives reflect reduced long-term risk. Energy savings improve borrower cash flows and repayment capacity. For SMEs, lower operating costs bolster resilience in downturns. Lenders benefit from stronger portfolios and brand differentiation. Education is part of the offer. Calculators estimate savings, payback, and emissions avoided. Case studies show real outcomes for peers. Borrowers make confident choices when benefits are tangible. Sustainability also guides operations. Paperless processes, remote assessments, and efficient servicing cut footprints. Partnerships with installers and auditors ensure quality. Green lending proves that doing good and doing well can reinforce each other.

Green Loans and Sustainable Credit