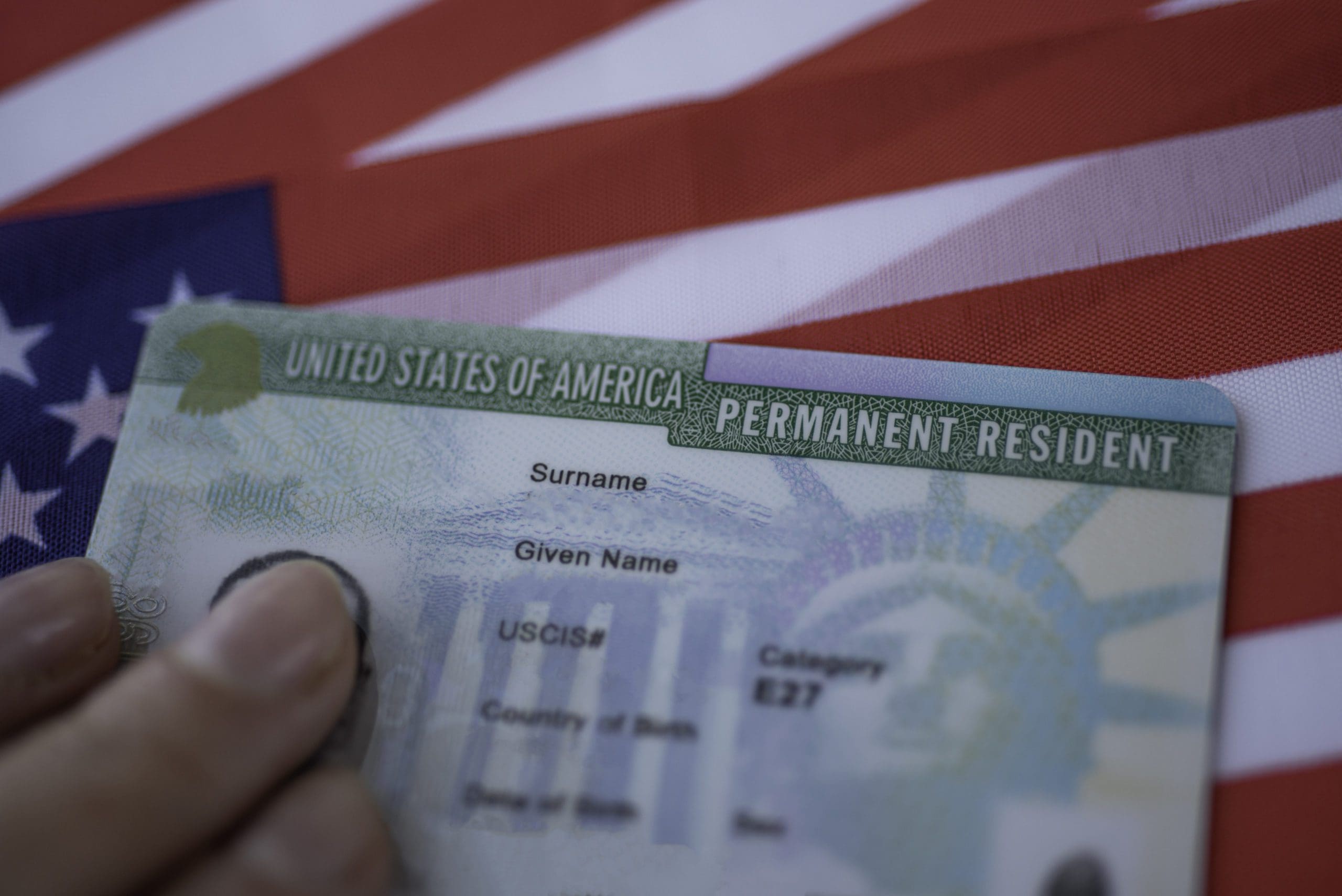

In 2026, banks are cautious and compliance-heavy, especially with cross-border startups. Founders must think like underwriters when approaching account openings. Prepare detailed KYC packs and clear business plans. Show that your company is low risk and high clarity. Segment your treasury early. Use a primary operating account for receivables and payables. Keep a reserve account for taxes and runway. Consider a specialist provider for multicurrency collections. Payment flows should be mapped and documented. Explain counterparties, volumes, and regions. Provide sample contracts and expected transaction frequencies. This helps banks monitor without constant queries. Be prepared for periodic reviews. Refresh UBO, financials, and proof of address on schedule. Automate document reminders so nothing lapses. Consistency builds trust with relationship managers. Have a contingency plan for provider outages. Maintain a secondary payment rail for payroll and vendors. Confirm your accountant can reconcile multiple platforms. Redundancy reduces operational risk as you scale.

Banking the Newco: How to Open Global Accounts When Banks Are De-Risking