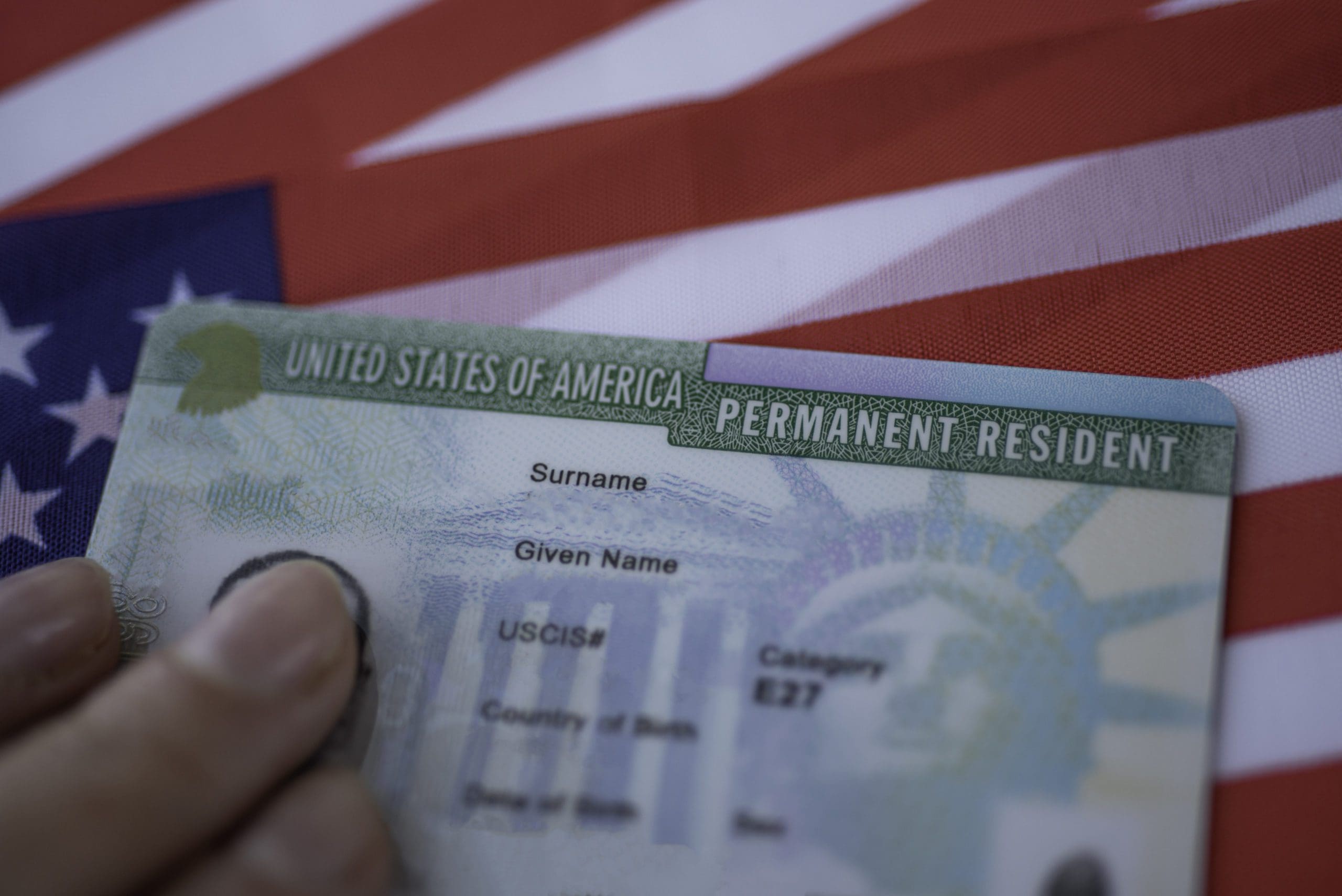

Investors and customers increasingly expect environmental and social commitments. Making ESG part of incorporation signals seriousness. Charter a committee, define material metrics, and publish a roadmap. Then tie compensation or bonuses to measurable goals. Choose metrics relevant to your sector and stage. Early targets might include energy usage, diversity, and supplier screening. Disclose methodologies and data sources. Transparency matters more than perfection. Bake ESG into procurement and vendor selection. Require attestations for labor standards and emissions claims. Prioritize suppliers with verified practices. This cascades your standards through the value chain. Communicate progress with concise, periodic updates. Celebrate wins and explain setbacks honestly. Investors appreciate momentum and candor. Consistency beats splashy but rare reports. Treat ESG as operational, not ornamental. When goals map to product and process, they endure. Customers see authentic alignment, not marketing. Over time, this strengthens valuation and loyalty.

ESG at Incorporation: Turn Bylaws Into a Competitive Advantage