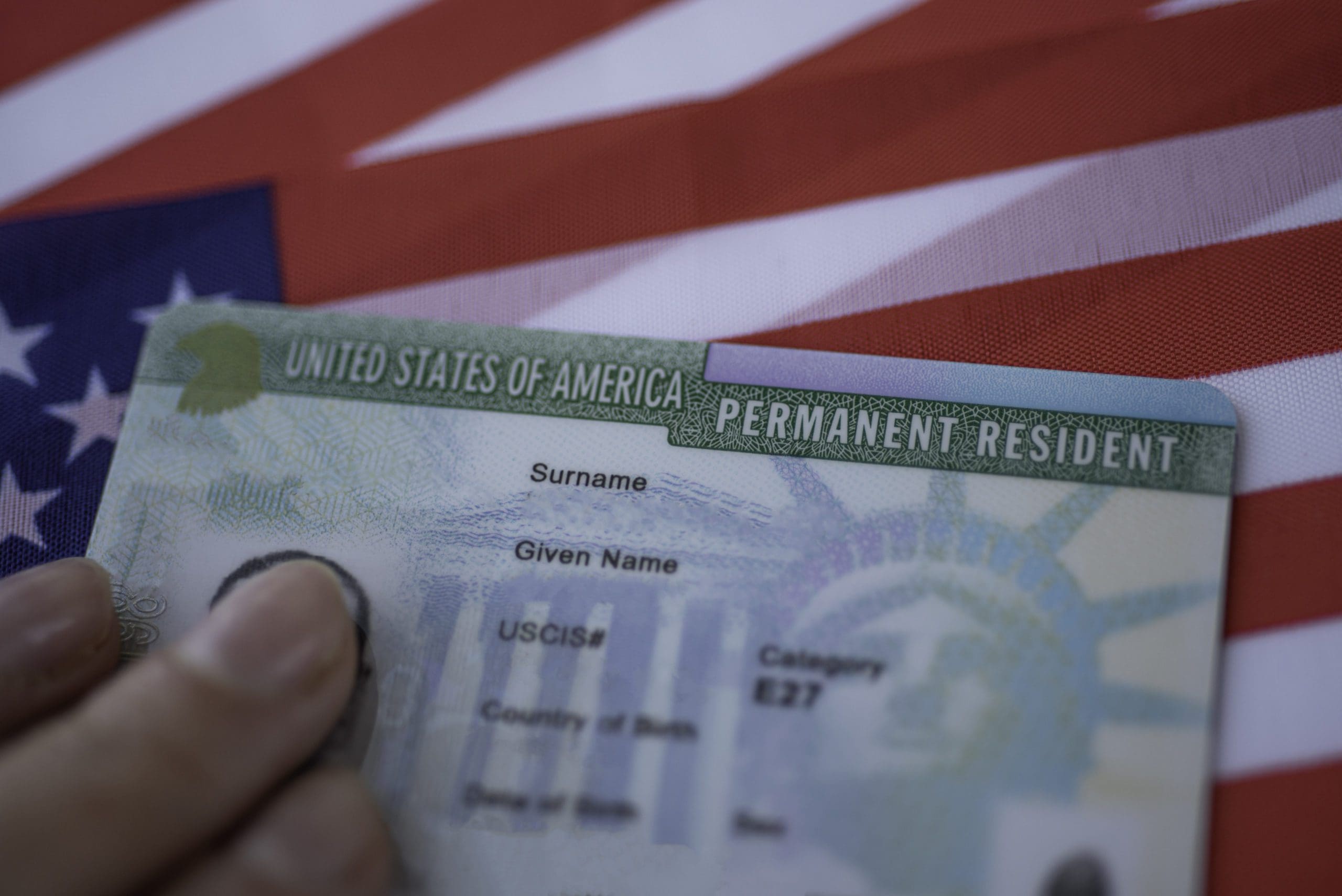

Every year brings new rankings of where to incorporate, yet fundamentals persist. Founder-friendly means predictable law, efficient registries, and bankability. Add to that access to capital and talent. The best jurisdiction is the one that aligns with your go-to-market. Speed still matters at the idea stage. Prioritize places with fast digital filings and e-sign acceptance. Verify how quickly you can open accounts and issue shares. Days saved early reduce friction later. When raising capital, investor familiarity counts. Some hubs make diligence and enforcement straightforward. That comfort lowers perceived risk and cost of capital. It can outweigh small tax differences. Operational reality beats theoretical advantages. Pick where you can hire managers, close customers, and protect IP. Check the ecosystem for lawyers, accountants, and payroll support. A strong local network multiplies founder time. Finally, plan for evolution. Your first entity may not be your last. Anticipate holding companies, subsidiaries, and mergers. Build with clean governance so future moves are easy and defensible.

Founder-Friendly Jurisdictions in 2026: What’s Really Changed and What Hasn’t