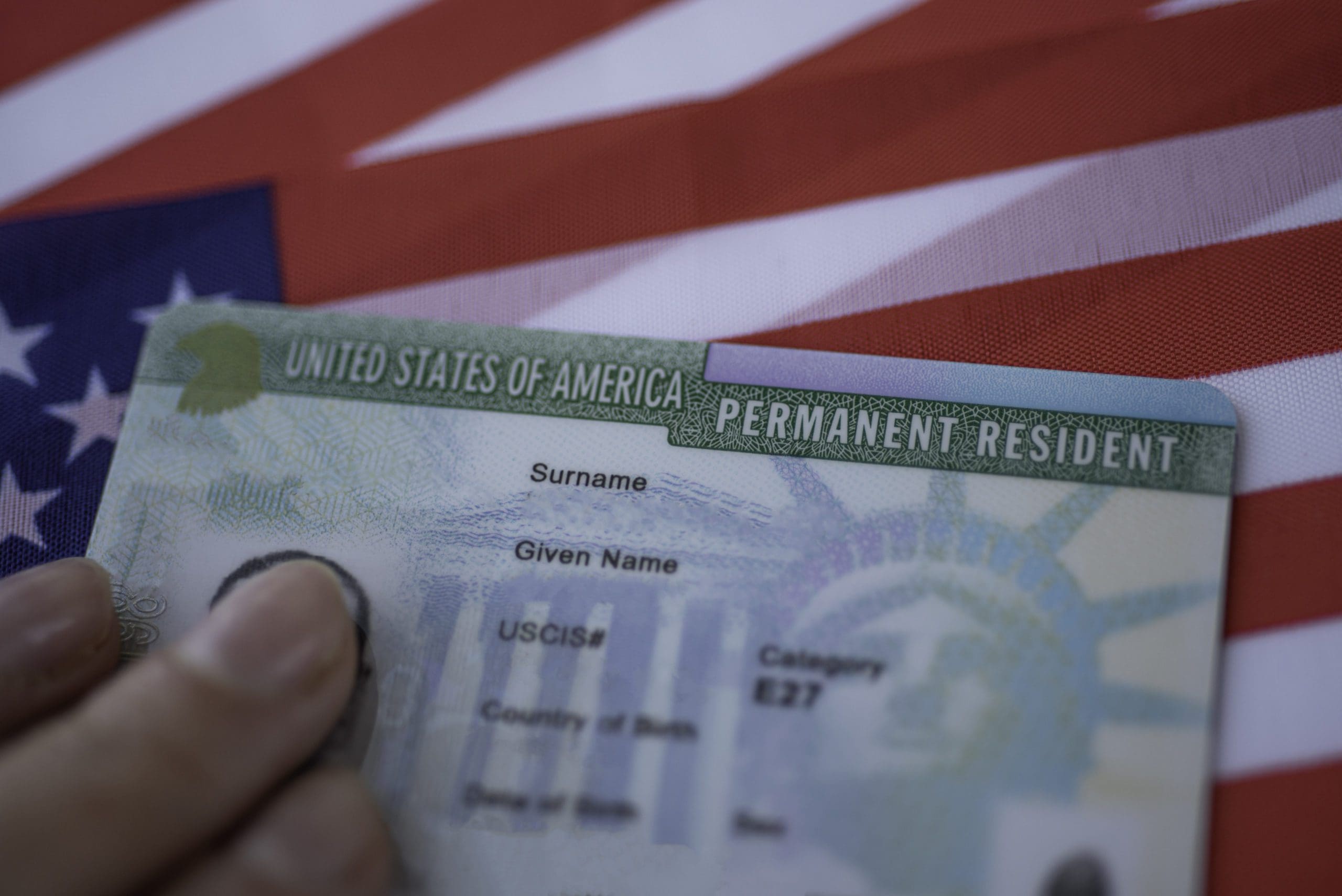

Insurance often feels like a grudge purchase until something goes wrong. In 2025–2026, smarter parametric options are gaining ground for parcels. Payouts trigger on events like declared loss scans or temperature excursions. That speed reduces paperwork and accelerates customer refunds. Tier coverage to shipment value and risk profile. Low-value, low-risk parcels can roll up under blanket coverage. High-value electronics or jewelry deserve named-peril policies and tighter chains of custody. Matching coverage to reality keeps premiums efficient. Data makes underwriting fairer. Share historical loss rates by lane and packaging type to earn better terms. Demonstrate sealed-carton controls and CCTV in high-risk nodes. Insurers reward provable discipline with lower rates and fewer exclusions. Train customer support on claims readiness. Clear photos, invoices, and scan histories shorten resolution time. Automated claims packets should assemble the moment an exception occurs. Fast, predictable outcomes preserve customer trust after a bad experience. Review policies quarterly, not yearly. As lanes shift and product mixes change, risk profiles evolve. Adjust deductibles and coverage caps to stay aligned with the business. Insurance should be a living safeguard, not a set-and-forget line item.

Small Parcels, Big Protection: Smarter Shipment Insurance