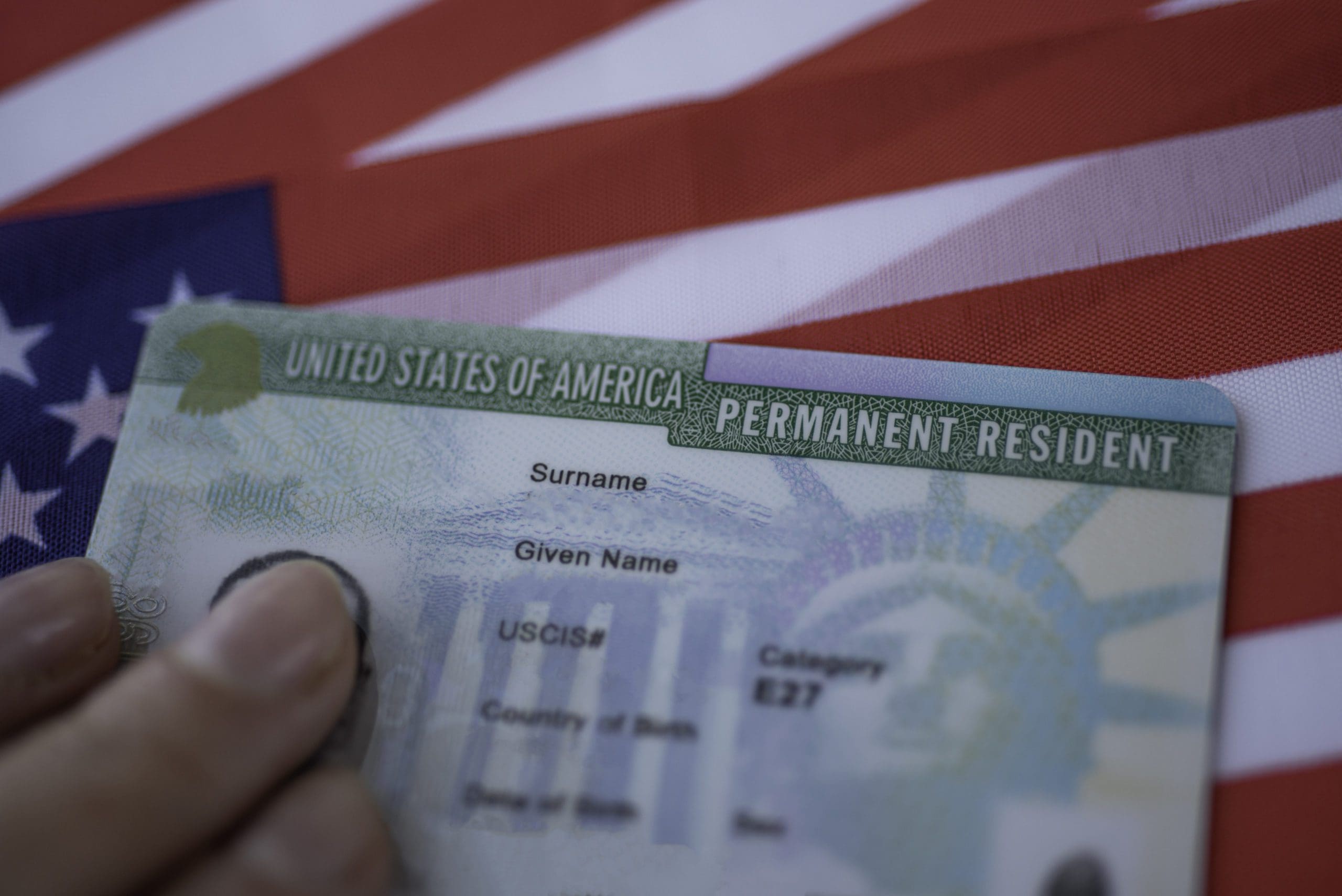

Remote-work visas have matured into stable programs by 2026. Requirements usually include income thresholds, private health insurance, and proof of remote employment. Applicants should secure employer letters confirming location independence. Tax considerations must be addressed before arrival. Residency length and renewals vary widely. Some programs allow family members and limited local work. Read the fine print on dependents’ schooling and healthcare access. Align stay plans with school calendars and policy windows. Insurance is non-negotiable for most schemes. Comprehensive policies covering care and evacuation are preferred. Keep certificates and coverage summaries on hand for inspections. Renew early to avoid accidental lapses. Banking and taxation require careful planning. Many countries expect local accounts or recognized fintech alternatives. Consult cross-border tax advisors to avoid double taxation. Document treaty positions where applicable. Community integration boosts well-being and compliance. Register with local authorities and follow address rules. Respect co-working norms and visa conditions on volunteering or freelancing. Responsible participation keeps programs politically sustainable.

Digital Nomad and Remote Work Visas