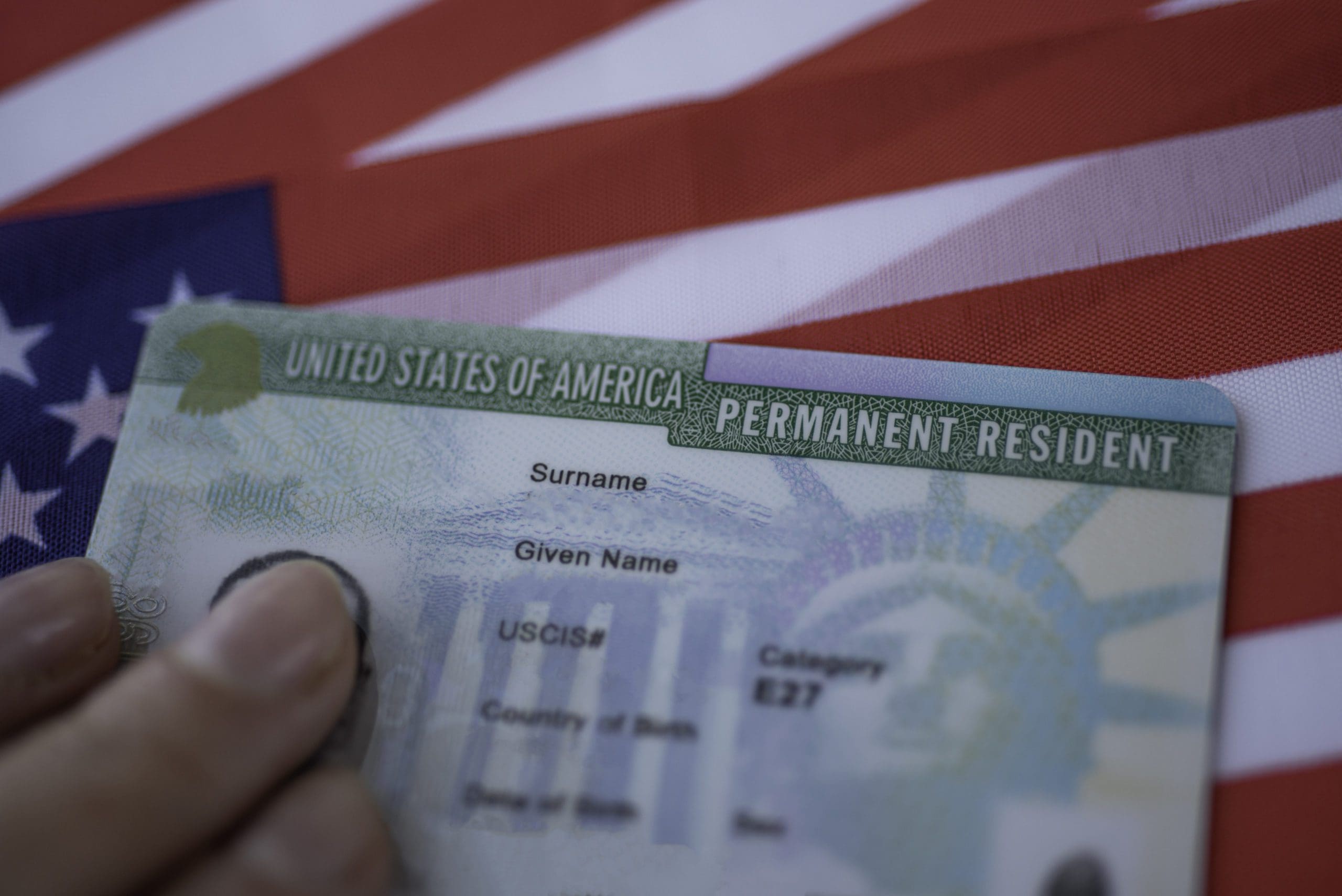

Artificial intelligence has moved from pilot projects to production-grade underwriting in consumer and business lending. Lenders now combine explainable models with policy rules to balance speed and fairness. This hybrid approach reduces manual reviews while meeting audit and compliance expectations. Borrowers benefit from faster decisions and more consistent outcomes across channels. Bias mitigation is no longer optional; it is engineered into model lifecycles. Teams monitor feature drift, adverse action reasons, and outcome parity across protected classes. Regular model validation and challenger models help avoid performance decay. Clear disclosures and opt-outs build trust without slowing approvals. For personal loans, AI models now ingest payroll data, bank transactions, and verified identity signals. That richer picture reduces default rates for thin-file applicants without penalizing them for limited credit history. In payday and short-term credit, risk flags trigger dynamic affordability checks before disbursement. The result is responsible access rather than blanket denials. In business lending, AI interprets invoices, POS feeds, and commerce-platform data in near real time. Seasonality and cohort behavior are modeled to right-size limits and terms. Lenders can approve viable SMEs that traditional scorecards overlook. Portfolio managers get early-warning signals to adjust exposure before delinquency spikes. Governance underpins all of this progress. Institutions document data lineage, approval thresholds, and human-in-the-loop overrides. Internal audit works alongside data science from day one. With the right controls, AI underwriting delivers speed, accuracy, and defensibility at once.

AI Underwriting Grows Up