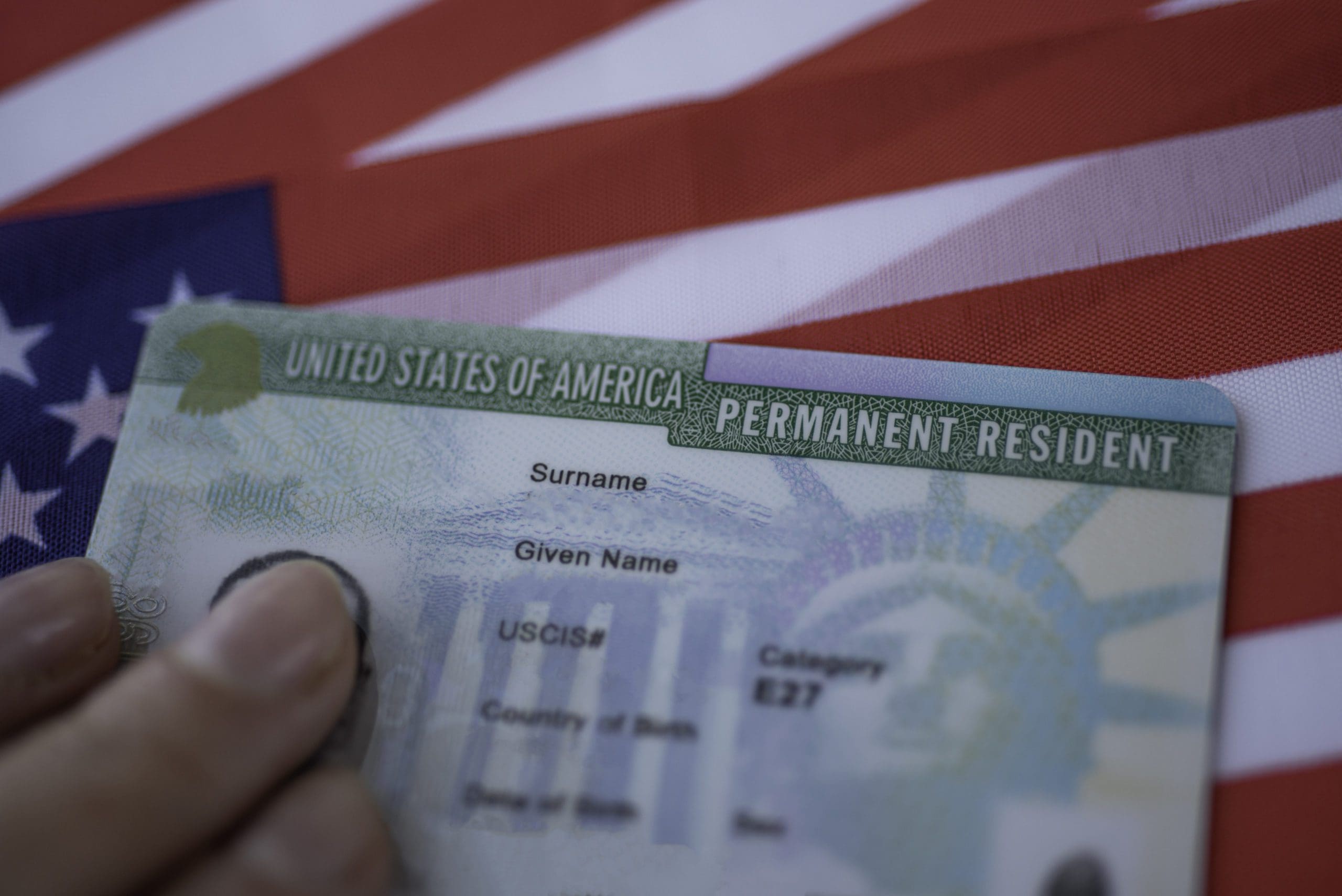

Credit inclusion advances when lenders look beyond traditional files. Rent, utilities, telecom payments, and verified income streams paint a fuller picture. This helps newcomers, migrants, and young adults qualify on merit. Scorecards expand capability without diluting prudence. Data quality matters more than data quantity. Providers prioritize verified sources, consistent refresh cycles, and clear consent. Features that correlate with ability and willingness to repay make the cut. Spurious or sensitive signals are excluded to protect fairness. Personal loans benefit from stable bill payment histories. Applicants with limited bureau footprints still demonstrate reliability. Adaptive limits and starter APRs reward good behavior over time. Graduation paths transform short-term borrowers into prime customers. In payday contexts, alternative data detects distress early. Lenders can redirect applicants to lower-risk products or budgeting support. Responsible declination becomes part of a long-term relationship, not a dead end. Trust builds when advice accompanies decisions.

Business lenders use commerce dashboards and payout histories as proxies for resilience. Seasonal dips are treated differently from structural declines. Facilities scale with verified demand rather than projections alone. Alternative data thus expands access while safeguarding portfolios.

Alternative Data, Fair Access