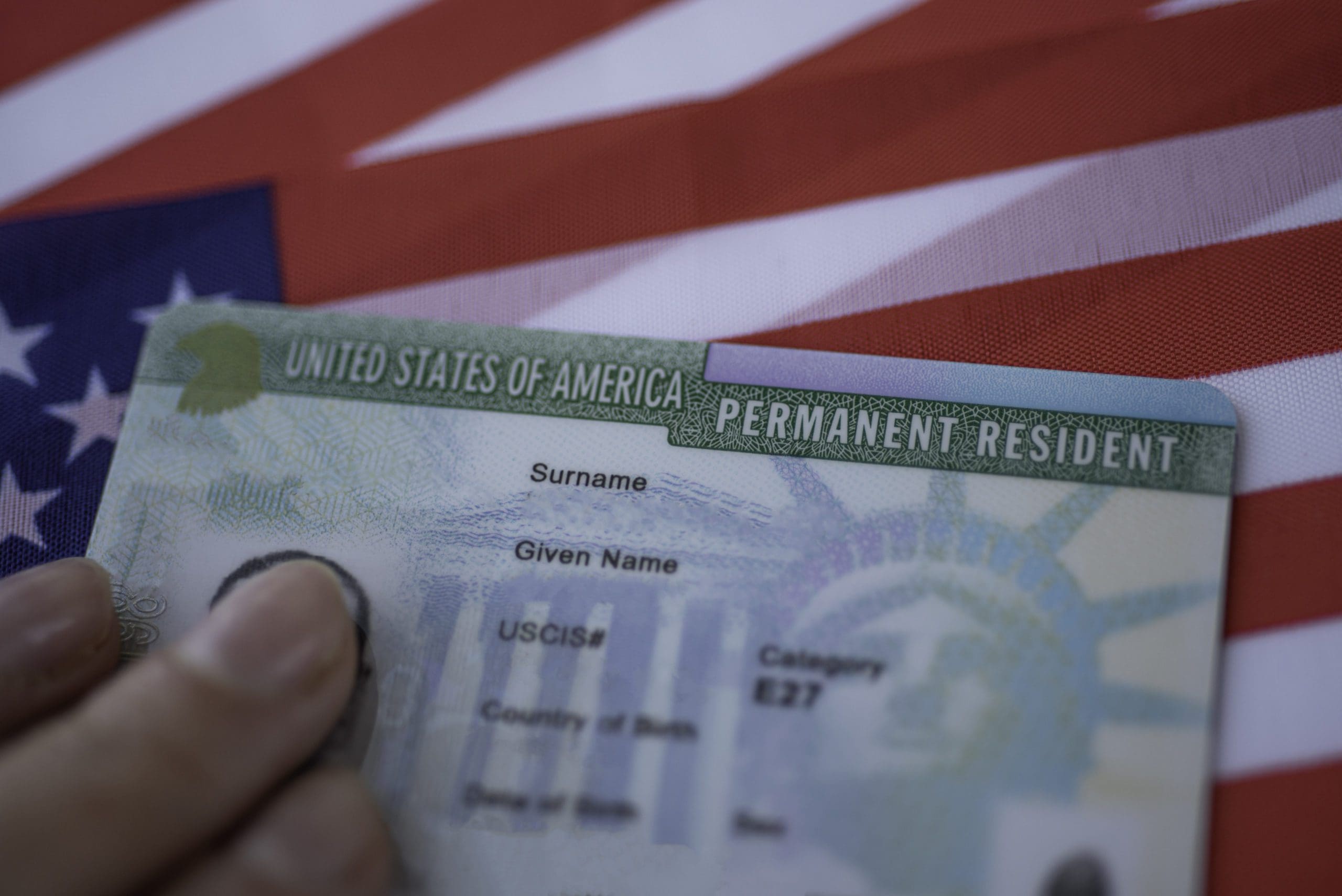

Investor migration has evolved significantly in 2026, with countries refining their residency and citizenship-by-investment programs to attract global capital. Golden visas, once considered niche, are now mainstream in Europe, the Middle East, and parts of Asia. Nations such as Portugal, the UAE, and Singapore continue to lead, offering investors residency in exchange for real estate, innovation funding, or direct capital inflows. Meanwhile, the United States has adjusted its EB-5 program to create more accessible opportunities for foreign investors while ensuring stricter oversight on fraud prevention. These pathways are designed to inject resources into national economies while giving investors and their families a secure global base. The appeal of golden visas lies in their dual promise of financial security and personal mobility. High-net-worth individuals see these programs as a hedge against economic or political instability in their home countries. By acquiring residency or citizenship through investment, they gain access to visa-free travel, robust education systems, and high-quality healthcare. This mobility has become increasingly valuable as global markets remain volatile and geopolitical tensions escalate. For many, golden visas are not just about migration—they are about building a multi-generational safety net.

Governments benefit greatly from these schemes, using the inflow of capital to fund infrastructure, healthcare, and economic diversification. For example, several Caribbean nations have revitalized their tourism and energy sectors with golden visa revenue. In Asia, investment programs are channeling funds into technology parks, renewable energy projects, and smart city initiatives. These programs create a mutually beneficial relationship: investors secure opportunities for themselves, while host nations gain long-term economic resilience. However, investor visas are not without controversy. Critics argue that they favor the wealthy, creating unequal access to immigration opportunities. Some programs have faced allegations of corruption or misuse of funds. In response, many countries in 2026 are tightening due diligence standards and requiring proof of legitimate capital sources. This ensures programs remain credible while protecting the integrity of national immigration systems. Transparency and compliance are now key to sustaining global confidence in golden visas. Looking forward, the future of investor migration will be defined by sustainability. Increasingly, golden visa programs are linked to socially impactful investments, such as green energy, affordable housing, or education. Investors are no longer just buying access—they are contributing to meaningful change in their host countries. This evolution makes golden visas not only a pathway for wealth mobility but also a vehicle for global development.