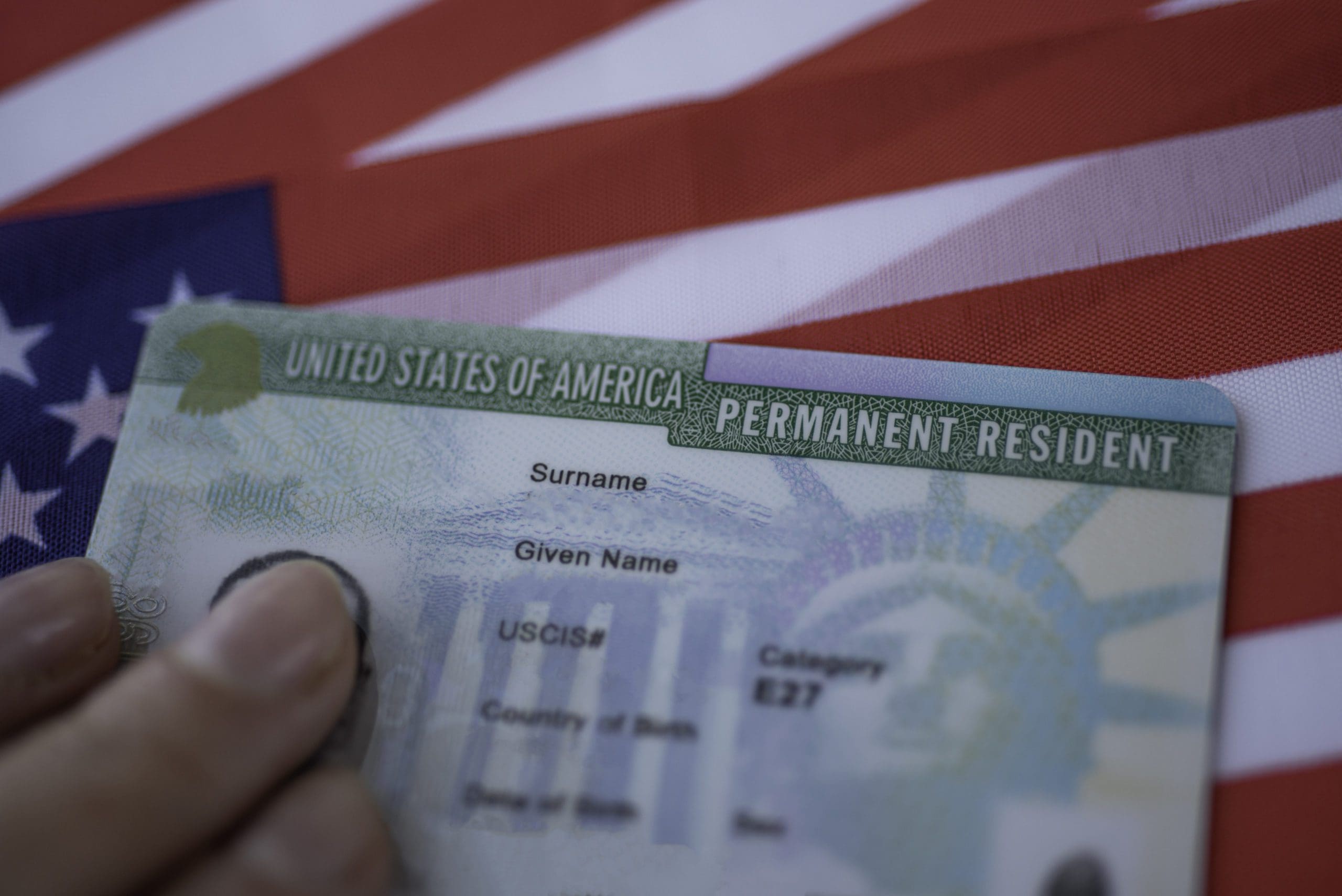

UBO disclosure requirements continue to expand, and 2026 formations must assume transparency by default. Registries are interlinking, and banks demand corroboration beyond self-certifications. New founders need a disciplined approach to documenting ownership and control. Clean UBO files accelerate banking and vendor onboarding. Start with a standardized UBO map that visualizes every layer. Include percentages, voting rights, and any convertible instruments. Attach government-issued IDs, proof of address, and source-of-funds statements. Keep the packet updated as your cap table evolves.

Nominee arrangements and opaque trusts draw scrutiny. If you use them, articulate the legitimate purpose and provide full look-through documentation. Ensure board minutes reflect the true decision-makers. Misalignment between records and reality can freeze accounts at critical moments. Centralize compliance in a secure data room with version control. Give auditors and banks read-only access to specific folders. Track consent and access logs for accountability. A well-run repository saves weeks during expansions. Train internal admins to manage ownership changes. Every issuance, transfer, or SAFE should trigger a UBO refresh. Routine hygiene is cheaper than emergency cleanups. The right habits make regulatory reviews straightforward rather than stressful.